Organizations tend to focus on booking efficiency, preferred airlines, and per-diem limits. Meanwhile, the fine print that determines whether a six-figure overseas medical bill gets paid is quietly doing push-ups in the background. When something goes wrong, finance teams discover that optimism is not a recognized payment method.

Where Claims Quietly Fall Apart

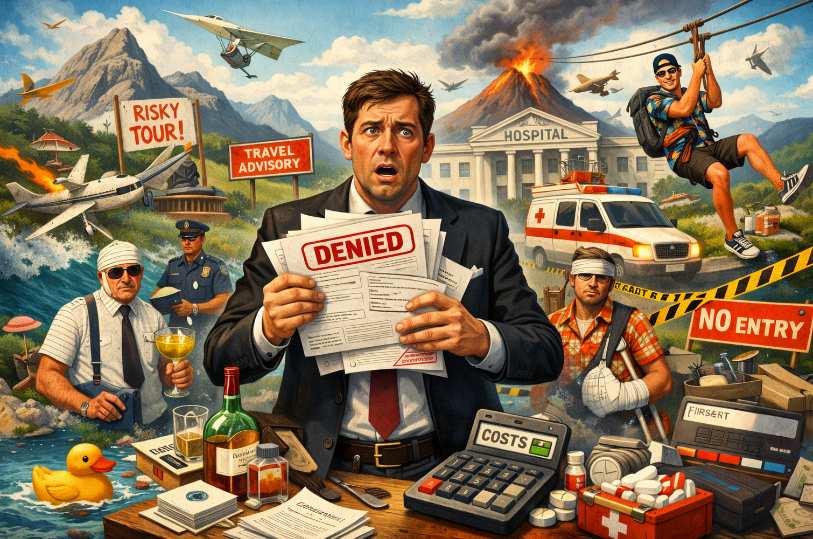

Many denied claims follow predictable patterns. None are dramatic. All are preventable. The trouble is that they sit in the gray space between personal responsibility and corporate oversight.- Pre-existing medical conditions that were never disclosed because the traveler felt “mostly fine.” Insurance providers are remarkably unsentimental about “mostly.”

- Participation in higher-risk activities that sounded harmless during itinerary planning but appear very different in a claims report.

- Incidents involving alcohol, where the official documentation reads less like a business trip and more like a cautionary tale.

- Travel to destinations flagged by government advisories, often approved internally with a shrug and a calendar invite.

Policy Design That Assumes Humans Exist

Corporate travel frameworks often read as if written for perfectly rational people who hydrate regularly, disclose medical histories without hesitation, and treat hotel minibars as decorative furniture. Real travelers are more creative.Effective policy design accepts this reality and builds guardrails instead of wishful thinking. Clear medical disclosure requirements, explicit guidance on restricted activities, and destination approval tied to official advisories turn vague expectations into enforceable standards. More importantly, they shift responsibility from last-minute judgment calls to structured preparation.

Serious organizations also connect these rules to reimbursement eligibility and duty-of-care obligations. When compliance determines whether expenses are covered, attention levels rise dramatically. Nothing sharpens memory like the possibility of paying for an overseas emergency personally.

The deeper issue is cultural. Travel risk is often treated as an operational footnote rather than a financial exposure. Until a denied claim lands on the balance sheet, it rarely earns executive focus. Afterward, it becomes everyone’s favorite topic.

Turning Compliance Into Routine Behavior

Rules buried in a 40-page travel handbook rarely change behavior. Busy employees skim, nod thoughtfully, and continue living exactly as before. Real compliance appears when guidance becomes part of the booking and approval workflow rather than an inspirational document no one remembers reading.Practical steps make a measurable difference. Pre-trip checklists that require confirmation of medical disclosure, destination safety status, and activity plans create small pauses where better decisions can happen. Automated prompts inside travel-booking systems work even better, because software is wonderfully persistent and never assumes everything will probably be fine.

Training also matters, though not in the form of dramatic slide decks filled with stock photos of airplanes. Short, scenario-based briefings tied to real incidents help travelers understand how ordinary choices lead to denied claims. When people see how quickly a minor oversight becomes a major invoice, attention improves noticeably.

Finance and HR teams play a quiet but decisive role here. Linking reimbursement eligibility to documented compliance transforms policy from suggestion into operating reality. Nobody enjoys administrative friction, yet it remains one of the most reliable teachers in corporate life. Even the most adventurous sales executive becomes remarkably detail-oriented when receipts, approvals, and coverage all need to align perfectly.

Stamping Out Surprises Before Takeoff

Denied insurance claims rarely stem from mystery or bad luck. They grow from predictable gaps between what policies assume and how travel actually unfolds. Closing those gaps does not require dramatic transformation, only consistent attention to the moments where risk quietly enters the itinerary.Organizations that succeed treat travel risk as a financial control, not a travel perk. They document expectations clearly, verify compliance early, and respond quickly when conditions change. Over time, this approach reduces uninsured incidents, stabilizes costs, and prevents urgent calls that begin with unusually long silences.

There is also a subtler benefit. Travelers who feel supported by clear guidance and reliable protection tend to make calmer decisions when problems arise. Instead of improvising solutions that later confuse insurers, they follow established steps that keep coverage intact and recovery faster. Stress levels drop, paperwork improves, and crisis meetings become less theatrical.

Corporate travel will never be perfectly predictable. Flights delay, luggage wanders off on personal journeys, and someone will always insist a “quick scooter ride” counts as reasonable transportation. Still, thoughtful policy design ensures that when plans go sideways, the company balance sheet does not follow.

Article kindly provided by travelinsurancequotes.net.au